The Rising Cost of College

For millions of students across the country, the dream of attending college is dominated by the overwhelming question: Can I even afford it? While scholarships, grants, and other financial aid options exist to help students pursue their dreams, the reality is that those are not easy solutions for everyone.

Due to complicated systems when applying, limited resources, and widespread inequalities, financial aid is more than just filling out a form.

Each year, nearly 60% of American families rely on scholarships and grants to assist with a portion of college tuition costs. So why do only three-quarters of students who apply receive help?

The most common requirements for the majority of two-to-four-year scholarships are a GPA of 3.0 or higher, SAT scores, class rank, extracurriculars, special achievements, and, according to the Smarter Select College Criteria Blog.

However, not all students applying for scholarships can fulfill these requirements. Tuition and fees at private, out-of-state, in-state, and national universities have each increased by at least 24% (adjusted for inflation), yet financial aid numbers aren’t mirroring this.

The Unfair Struggles

An example of the inequality is need-based aid, like the Pell Grant which was created specifically to help low-income students who don’t have the required funds to attend college. Nonetheless, the maximum awarded amount has not kept up with rising tuition. Many students still need to borrow thousands of dollars in student loans to fill the gap.

According to the College Board, the average cost of tuition and fees at four-year public universities is over $10,000 a year for in-state students. In 2022, the national average for in-state enrollment was 73%.

Underrepresented and low-income students also lack equal access to test prep, extracurriculars, or support systems that help with competitive applications.

Kate Bradley, a reporter for Ballard Brief, says, “Researchers have largely focused on the racial achievement gap, resulting in a lack of scholarship regarding the socioeconomic achievement gap”. Furthermore, many scholarships require resources and access to counselors that students in underprivileged areas don’t have.

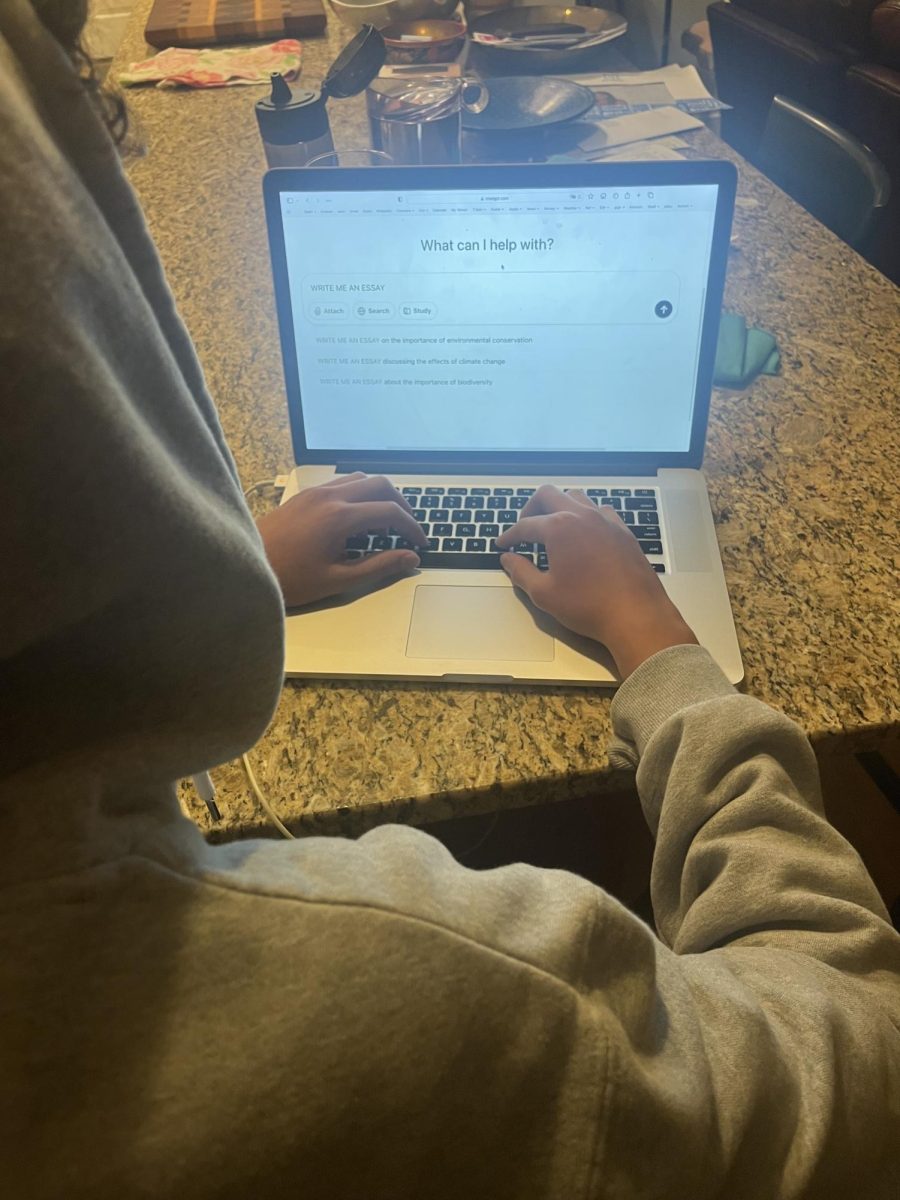

Another common struggle is the Free Application for Federal Student Aid (FAFSA) application. The form contains many detailed, confusing questions about income, taxes, and household information, according to studentaid.gov.

The lack of proper education on how to fill out applications from FAFSA to scholarships is common. “Out of nearly four million graduating seniors in 2025, about 1.6 million did not complete the FAFSA”, Sara Weissman, a reporter at Inside Higher Ed says.

Weissman writes about students from underrepresented backgrounds and the colleges and universities that serve them. This is why many students think they are ineligible for financial aid, when in reality, they just don’t know what they’re missing. If one is struggling or feeling overwhelmed, Student Aid is a valuable resource to utilize when applying.

However, the unavailability of resources and the income eligibility aren’t the only issues that students encounter when seeking aid.

So What Can We Do?

While it’s recommended to begin researching colleges and financial aid options at least a year before application deadlines, it’s never too late to begin.

First, students should focus on learning the difference between grants, scholarships, loans, and other specific aid options.

Then, they search for reliable information on the schools they’re considering and/or suitable financial aid options. They should make sure to look for scholarships and aid options based on their background, interests, achievements, and intended major. Scholarship search engines like Fastweb or Niche are great ways to start.

It’s Not A Small Process

Going to college is one of the biggest decisions that students can make; it’s more than just picking a school and hitting the road. Understanding what college life is all about, how to finance it, and how to set oneself up for success are issues that everybody planning on going to college will run into.

Making college scholarships more accessible to students will ensure equitable access to higher education, reduce student debt, and empower lower-income communities to achieve both academic and economic success.